Where will rates go from here? We know what has happened: with the end of accommodative Fed policies, rates across the yield curve have risen sharply. And we know what is expected: the consensus is that the Fed will continue to increase short-term rates by raising the Fed Funds target and taking the appropriate open market activities to achieve those levels.

Since most credit unions use longer-term rates as the benchmark for their loans and loan participations, the key question today for loan portfolio management is therefore: what do these higher short-term rates mean for longer-term rates?

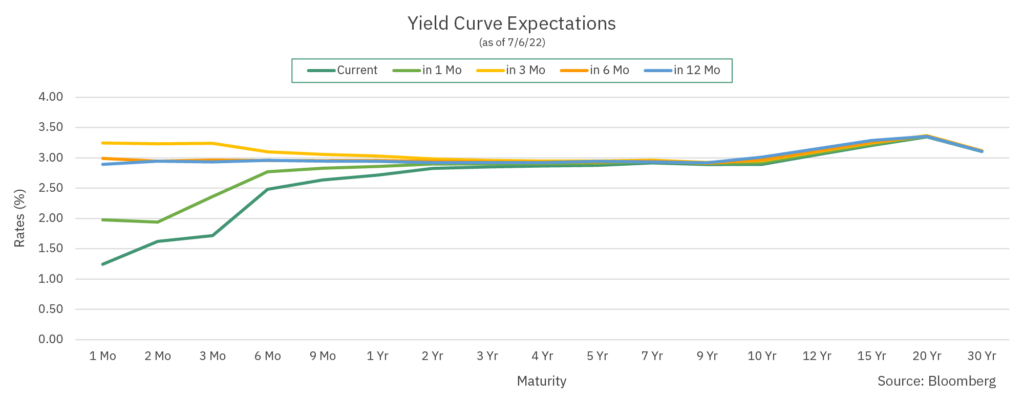

The shape of the yield curve gives us clues and can be used to calculate market expectations for future rates. Based on the current yield curve, longer-term rates are not expected to change materially over the next year. The 2-year Treasury, often a benchmark for auto loans, is expected to rise only 35 bps, and the 7-year Treasury, often a benchmark for mortgage loans, is expected to rise only 4 bps.

Waiting for a better entry point to make loans or purchase loan participations comes with the opportunity cost associated with sitting on cash. In fact, the market expects that waiting has very limited upside.