Commercial Loan Servicing

LoanStreet’s Commercial Loan Servicing (CLS) solution helps credit unions, community/regional banks and other lenders capture and service bilateral and participated commercial loan portfolios through a transparent, automated digital platform.

A Modern, Centralized Framework to Simplify Loan Servicing

Simplified Processes

LoanStreet helps lending institutions simplify commercial loan servicing operations by consolidating and streamlining traditionally complex processes with highly intuitive automated workflows, allowing lenders, servicers, and agents to confidently scale their business while minimizing operational costs

All-in-One Solution

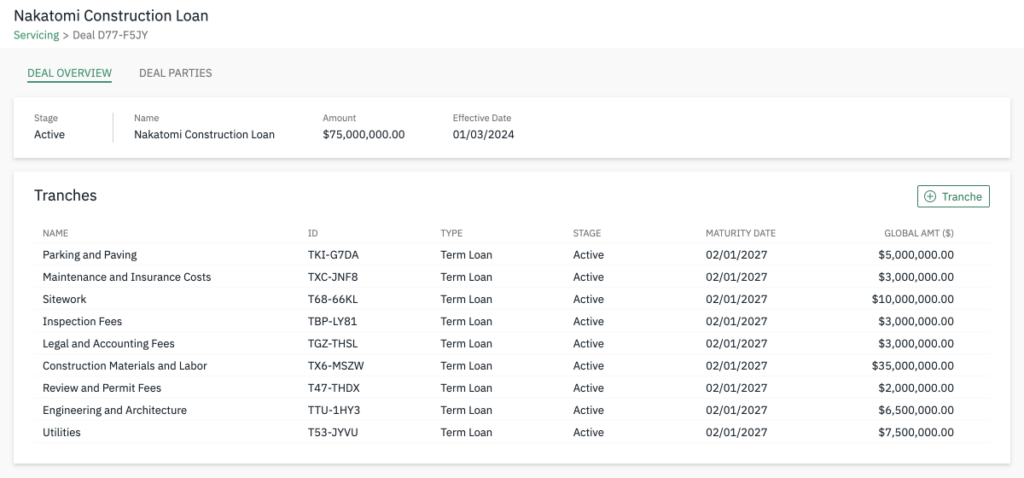

Our unified, secure technology stack helps efficiently manage servicing workflows while consolidating loan attributes, servicing details and covenant documents all in one place.

Single Source of Truth

Our platform centralizes traditionally disparate information and enables permission-based, transparent access for all parties of a commercial loan, including borrowers, agents and investors, empowering lending institutions to document and administer more deals with greater scale.

Commercial Loan Servicing Key Features

Intuitive, Automated Workflows

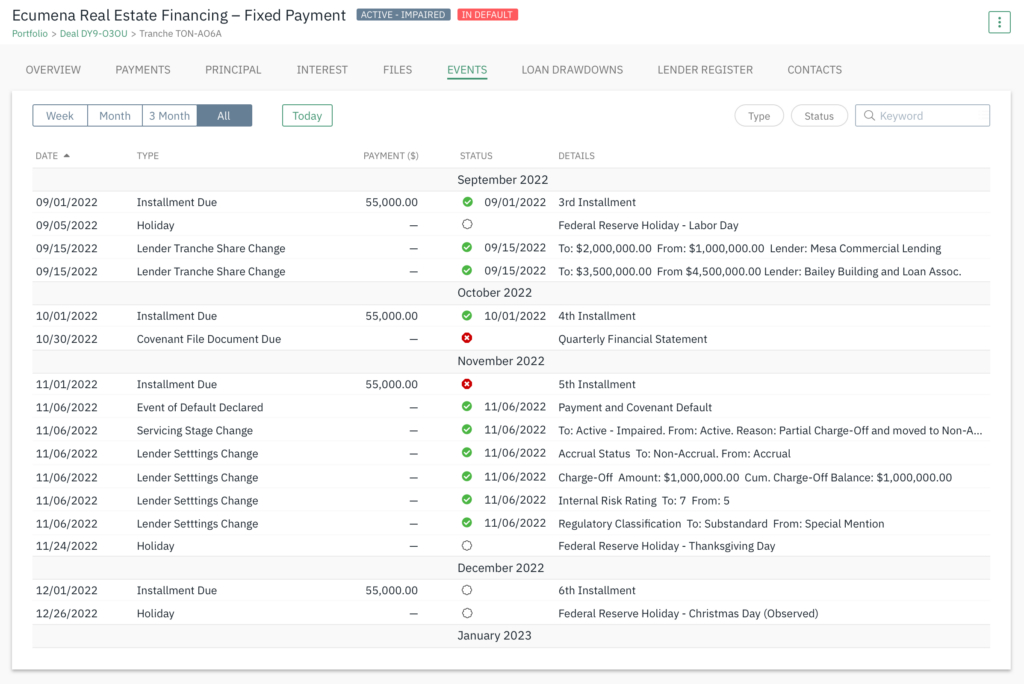

LoanStreet’s Commercial Loan Servicing offers robust tools to streamline communication across all parties, vastly improving otherwise arduous collaborative processes. Our self-serve portal provides a transparent, consolidated location for borrowers, agents and investors to view, track, and analyze their lending activities in real time. Streamline processes such as construction draws, invoice generation and interest election, with available accounting API integrations for further ease of use.

On-Platform Communication

All parties operate on a single, transparent platform, allowing them to easily request, share and service necessary documentation.

Permissions-Based Access

Documents and data are available 24/7, including every servicing event down to the payment level and daily interest accruals.

Real-Time Tracking

Parties can access servicing details at any time from both a loan and portfolio level view, receiving automated alerts for required actions and past-due items.

Consolidated Reports

Export consolidated and regulatory-compliant reports ready to share directly from the platform while identifying and remediating exceptions from counterparties.

Unified Data Model

Eliminate re-keying and operational risks by utilizing a singular location for all data and documentation, creating scalable processes without additional headcount.

Get in touch to learn more.

Request a demo today to see our commercial loan servicing solution in action.

Join the LoanStreet network today

Joining the platform is free and carries no obligation.

Get in touch with us today to schedule a product demonstration.