Corporate Loan Servicing

LoanStreet’s Corporate Loan Servicing (CLS) solution helps private credit direct lenders capture and service complex bilateral and syndicated corporate and commercial real estate loan portfolios on our secure, cloud-based platform. LoanStreet offers a unique suite of technical and collaborative features unavailable from any single loan management software provider.

Trusted by Our Clients and Partners

Fast, Efficient, and Secure Loan Servicing

Single Core Program for All

Direct lenders of all sizes can augment, if not replace, their legacy processes with a single source of truth. The unified and cost-effective technology stack replaces Excel, email, and document management systems to securely manage, track, and analyze any type of corporate and commercial real estate loans.

Our platform alleviates administrative burdens and exceeds the capabilities of any loan software product currently available to even the largest institutional lenders.

Robust User Workflows

Rule-based user workflows streamline otherwise cumbersome processes throughout the lifecycle of a corporate or commercial real estate loan, providing a transparent and efficient process for all parties to navigate: agents, lead lenders, co-lenders, and borrowers.

Loan Tracking and Analysis

With a single, unified database, lenders can track, analyze, and compare financial covenants on individual loans and across a portfolio.

Corporate Loan Servicing Key Features

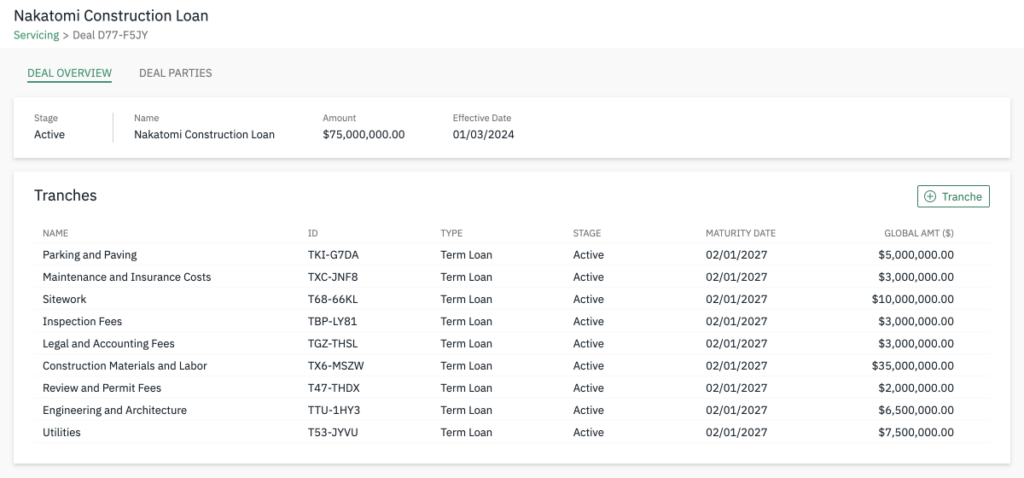

Full-Featured for Complex Loans

Corporate and commercial real estate loans are often so complex that they are frequently managed by agents and lenders in spreadsheets, which are error-prone and burdensome to administer.

LoanStreet’s servicing platform offers dynamic features and intelligent workflows that allow our clients to easily and efficiently service their entire corporate and commercial real estate loan portfolio, regardless of complexity, including:

- Asset-backed lending

- Benchmark rate automation for floating rate loans

- Complex fee support

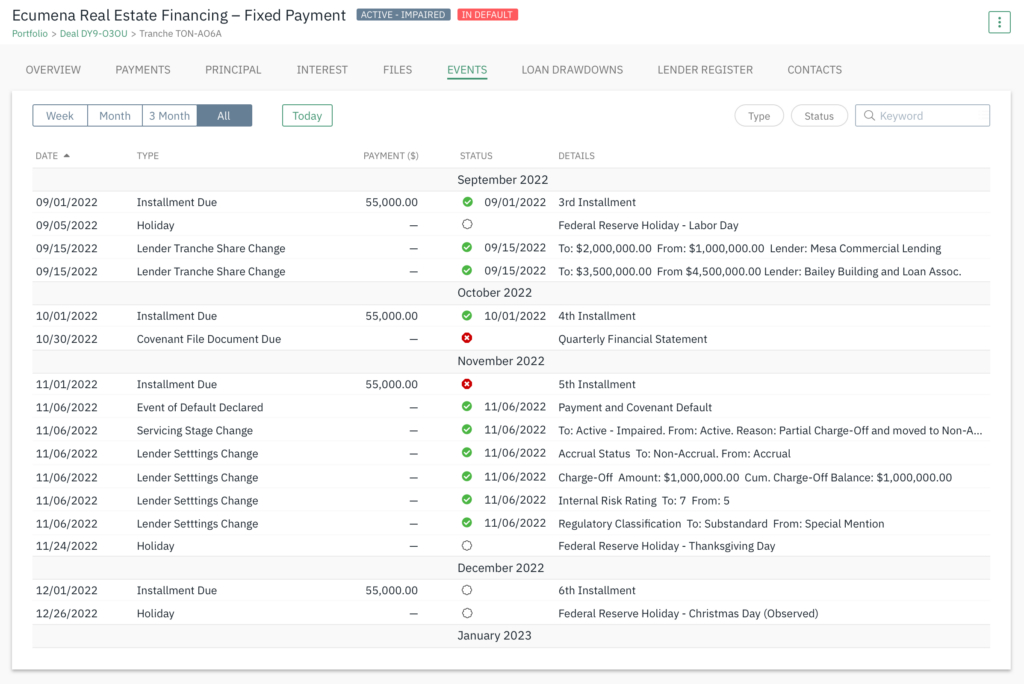

- Detailed event tracking

- Financial covenant tracking

- Manager/fund/SMA views, workflows and portfolio visualizations

- Non-pro rata funding and repayment

- Payment processing integration

- True PIK and PIK toggling

- Third-party advisor access

- Tiered pricing grid support

- Unitranche structures

24/7 Access

The platform is always available on a permissioned basis to all deal parties. With critical self-service functionality, LoanStreet allows you to manage the full life cycle of any loan type. Generate and receive borrowing notices, repayment notifications, and sensitive documents with secure, transparent communications.

Implement with Ease

Our implementation and integration options support continuity in loan data flows via API or SFTP file delivery. Users can now simply replace any servicing process and immediately benefit from LoanStreet’s fully digital servicing environment.

Get in touch to learn more.

Request a demo today to see our corporate loan servicing solution in action.

Join the LoanStreet network today

Joining the platform is free and carries no obligation.

Get in touch with us today to schedule a product demonstration.